Cash is king, queen, prince and princess when it comes to traveling abroad. Many developing countries do not have the infrastructure to support the rigid credit card processing requirements nor do the small shops have the ability to absorb the major credit card service fees making it essential to have plenty of cash on hand when traveling to less developed countries.

Know before you go:

Debit cards are one of the most efficient ways to access your cash while abroad as there are more than 3.2 million Automated Teller Machines (ATMs) spread across the world. Bringing the right debit card on your trip is just as important as bringing a valid passport. Without either one, your trip will be cut short.

Not all debit cards are created equal:

Before deciding what to pack in your suitcase, it is just as important to decide what debit card to pack in your wallet. There are many banks that charge exorbitant fees for using your card outside of the country and there are many banks that don’t. Ideally you want access to your cash anywhere in the world with no fees. With a bit of research, you’ll be sure to find a card that best suits your needs with no unnecessary surcharges for using it abroad..

Understanding fees:

There are several features that make one debit card better than others when it comes to traveling.It’s important to understand the fees that may incur when you use your card overseas. While at first glance, these fees don’t appear to be significant, they can quickly add up and put an unnecessary dent in your budget.

Potential bank fees for using your debit card while traveling abroad include the following:

- Foreign transaction fees (International fees): These are fees charged by your bank (debit card issuer) for using your card overseas. Fees can range from 1 percent to 3 percent. Check your bank’s website to see if they charge a foreign transaction fee.

- Currency conversion fees: Additional fees may be imposed by credit card payment processors (Visa/Mastercard) for converting the transaction into local currency. Fees are typically 1 percent.

How to avoid unnecessary fees:

Not all banks charge fees for using your debit card abroad. If you want to avoid these unnecessary fees it’s important to be an informed consumer. There are several good websites that take the confusion out of this decision by providing easy to read grids of the pros and cons of the top rated debit cards for international travel.

Capital One has many products that appeal to savvy travelers. I love the Capital One 360 checking account because there are no minimums and they don’t charge any fees regardless of where in the world you are. Additionally, in the industry, Capital One consistently earns top ratings for its travel credit cards. Check out Capital One Venture Card perks.

Don’t leave home without first doing these things first:

Allow three weeks for the process of getting a new debit card:

If you are looking to get a new debit or credit card, start the process at least two to three weeks prior to your departure. You’ll need this time to compare the travel benefits between cards, complete an application, open an account and receive your physical card.

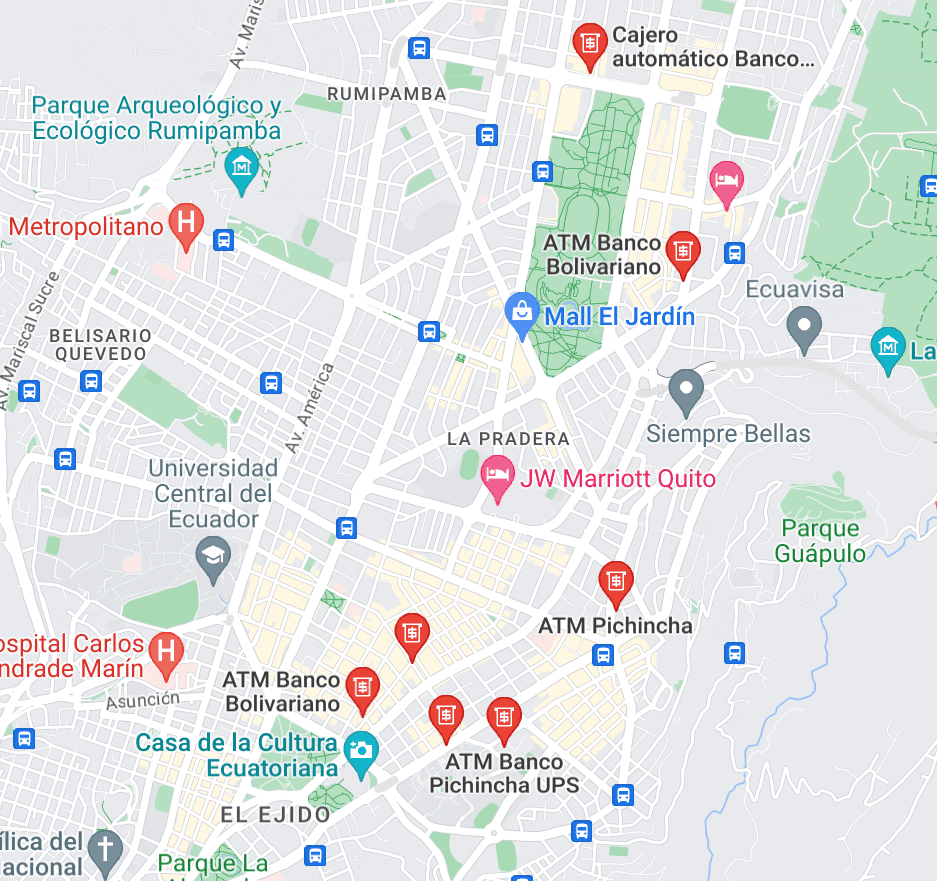

Map out the ATM locations throughout your journey:

Although there are millions of ATMs around the globe, you may want to be sure there are ATMs within close proximity to where you will be traveling. You can easily look up where all ATMs are located in a particular city by entering “ATMs in …” in your search engine. Bear in mind that ATMs in more remote areas may receive infrequent servicing, and it is common for these machines to run out of cash or shut off.

Don’t leave home without two:

How many debit cards to bring: I always carry two debit cards when traveling. My Capital One 360 debit card is my primary card and I use it for getting cash at ATMs and at any shop that accepts credit cards. I also carry another debit card for any “just in case” situations I may find myself in. If my primary card is lost, stolen, or compromised, I can still obtain cash with my backup debit card.

You are at your destination with your new card in hand now what?

As soon as you go through immigration and pick up your luggage, be on the lookout for an ATM.

These machines are usually scattered throughout the arrivals area and easily identifiable by their bright neon signs. Additionally, reputable banks often affiliate with airport ATMs, ensuring sufficient cash and optimal operating conditions.

The airport’s energy can be chaotic. It’s advisable to find a quiet area and organize yourself before standing in line at the ATM.

Before you step up to the ATM, be sure you know:

- The conversion rate between your home currency and the country’s currency. I use My Currency Converter to help with the calculations.

- How much money (in local currency) you need. Generally, I will start out with $100 USD in local currency. This is enough to get me to my hotel/hostel, check in and grab a bite to eat.

- The prompts of the ATM: When you are in a foreign country, you should assume the ATM prompts will be in the language of that country. If you’re lucky, there will be an option to translate the prompts into your native language, otherwise you may have to guess or ask for help.

- Home currency or local currency? ATMs will immediately recognize that your card was issued outside of the country. A message will appear, asking, “Would you like to be billed in local currency or in your card’s home currency?” Always choose the option to convert using “local currency,” as your bank will convert at the most favorable conversion rates.

What to do when you have no access to cash in a foreign country?

What if the ATM doesn’t work?

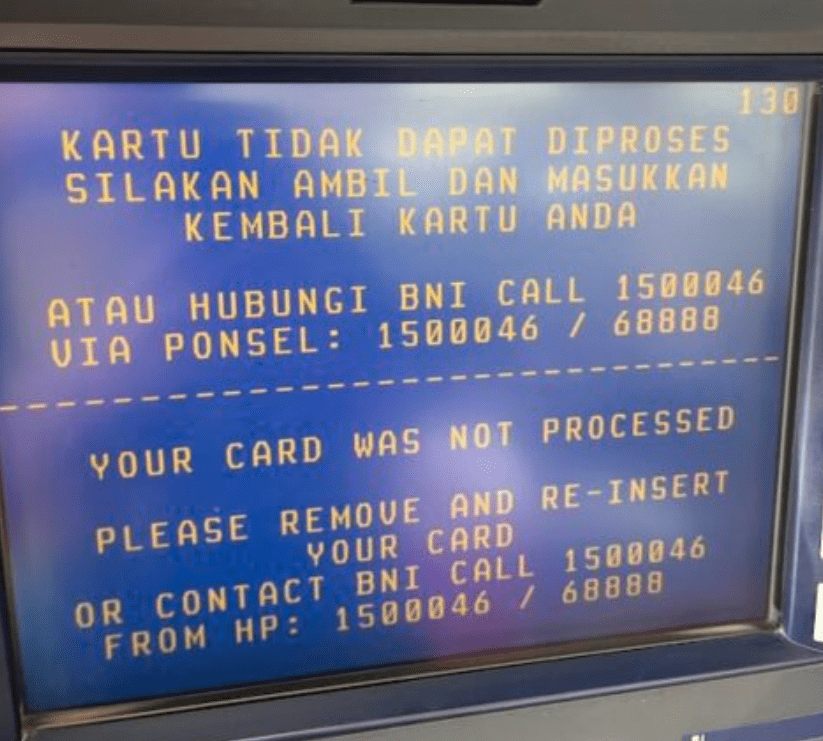

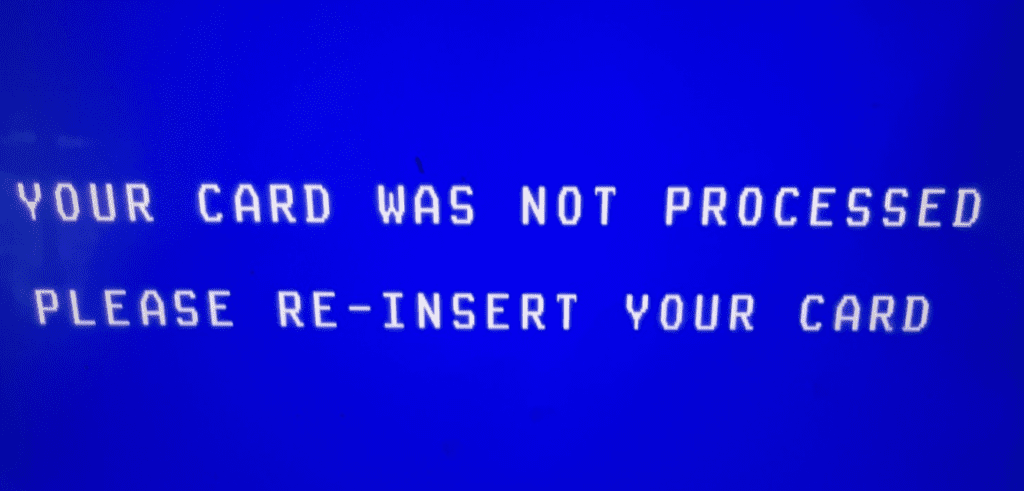

I never thought I’d be in the situation where my primary and backup debit cards would not work in an ATM, but I was. For a few hours, I was paralyzed with the fear of not having access to cash in a cash dependent country. For reasons still unknown, the ATMs in Bali would not accept my debit card. In large white font, the bright blue screen displayed a message stating, “Your card was not processed. Please re-insert your card.” My anxiety rose as I pushed my card into ATM after ATM along the commercial street in Sanur, Bali. The same message appeared on every single ATM screen I tried. I realized I. would not be able to get cash at any ATM in Bali.

Repeating a mantra that “every problem has a solution.” I quieted the chatter in my mind, sat down in a cafe and looked for options on the internet. Deep in a thread of a blog, a poster mentioned using MoneyGram or Western Union to send money to yourself. Was this a solution to my problem? Yes!

Thankfully, there was a MoneyGram office less than 5 kilometers from where I sat and within one hour. I was able to send myself money and pick up cash at the MoneyGram office.

What services do these companies offer?

Both MoneyGram and Western Union provide a platform that allows users to quickly, easily and safely send and receive money to anyone anywhere in the world. And that anyone can be you.

Because MoneyGram and Western Union have over one million agent locations around the globe, there is likely to be one close to you wherever in the world you are. Both companies have easy to use tools for sending and receiving money using your mobile phone, tablet or PC.

What you’ll need to send money to yourself or someone else?

- Passport

- The app

- Bank account information (routing number and account number) or debit card number

- Complete a “Send money” form

First and foremost you will need patience. Lots of it. Each office will have its own unique way of processing your request and it will take time. Allocate an hour or more to complete the transaction, as you will need to fill out forms and undergo identification verification.

Before leaving for your trip, download the MoneyGram and or the WesternUnion app and create a login. You might never need these services, but setting up an account in advance can reduce anxiety and wait time if you use them overseas.

Currency exchanges:

I’ve never considered using a currency exchange kiosk, relying primarily on ATMs to withdraw money. After experiencing the panic and desperation of not having access to cash, I’ve changed my mind and will use currency exchange kiosks as a backup to my backup.

Simply put, currency exchanges allow customers to swap one currency for another. Kiosks in the airport and throughout popular tourist destinations around the world offer these small money exchanges. Regard this option as a last resort for obtaining local currency, as large fees may be added. I suggest carrying a few larger bills in your home country’s currency and tucking them away somewhere safe so you have another way of accessing cash as a backup to your backup contingency cash.

As you plan your next adventure abroad, ensure you have a backup plan for accessing cash if your primary method fails.. With a bit of planning and preparation, you’ll have the peace of mind that comes with knowing you’ll be spending more time exploring the world instead of exploring the inside of a bank or a money transfer provider.

Pre-travel cash checklist:

- If you don’t already possess a no-fee debit and credit card, research banks that provide products with great rates and incentives, usable anywhere in the world with no penalties or fees.

- Complete the application process three weeks prior to the date of your departure to ensure your new card arrives in time.

- Review the ATM footprint where you will be traveling.

- Download a currency converter app on your phone. My favorite is the My Currency Converter.

- Download MoneyGram and Western Union apps and set up an account

- Stash away a few large denomination bills to use at a currency exchange as a last resort.